|

The usage of a daily quote computed from a formula, instead of real

quote has the main advantage of having a full set of controllable

characteristics like the noise/trend ratio or the length of the time

series and the not small advantage to be copyright free.

The formula for the computation of an artificial daily quote

(open,max,min,close prices) is written having in mind a

model for a real quote composed by two addends: a trend and a noise.

The adopted model does not pretend to be an accurate simulation of

real data, it is mainly addressed to the debugging and demonstration of

the trading system.

The Artificial Quote trend is computed as sum of 3 contributes:

a fixed bias, a linear trend, a sinusoidal oscillation. Around this trend,

the max-min range is computed as the product of a normal noise with a given

percentual of trend. The cross point between max-min range and trend is

computed as a uniform noise value with max-min range spanning. The same is

done for open and close prices. Amplitudes and periods of all these

components are given by a set of parameters.

Artificial Quote Parameters

| bias

| 10

|

| linear trend slope

| 1

|

| linear trend period

| 250 days

|

| sinusoidal trend amplitude

| 1

|

| sinusoidal trend period

| 250 days

|

| noise standard deviation

| 0.01

|

| quote length

| 500 days

|

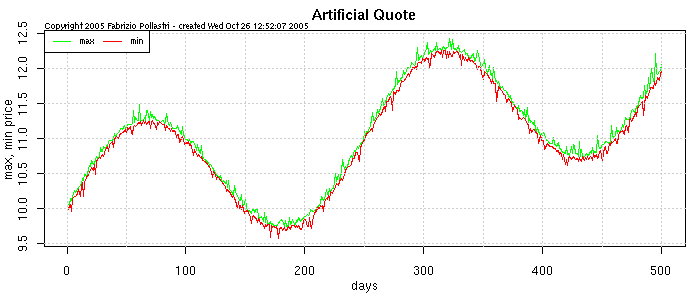

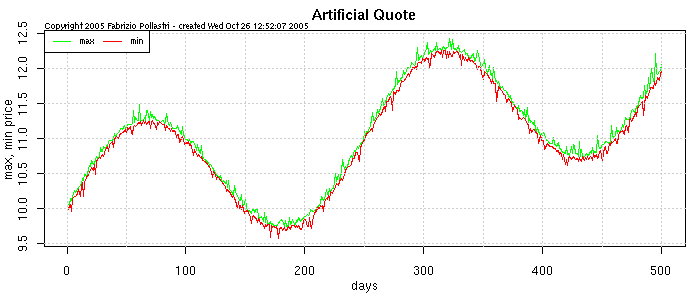

The plotting shows the maximum and minimum daily prices of the artificial

quote used to build the turtle trading demo. This artificial quote is

computed introducing in the formula the set of parameters shown in the

table.

You can refer the amplitude units (i.e. bias=10) to any currency

you like. The fixed bias is set to 10 units. The linear trend

slope is set to 1 units per 250 quotation days, approximately

corresponding to the number of the open days of financial markets in

one solar year. This lead to a reasonable positive linear trend of 10%

per year. The same concept is applied to the sinusoidal trend:

amplitude 1 units, period 250 quotation days. The sum of the two trends

give for every year and reference to year start, a maximum of about

+12.5% at the end of the first quarter, a middle value of about +5% at

half year, a minimum of about -2.5% at the end of the third quarter,

a final value of about +10% at year end. The percentual of trends sum

used to compute the daily price range (max - min prices) is set a normal

noise with a standard deviation of 0.01 units. This means a daily quote

price volatility of 0.01%, corresponding to the dynamics of a normal market

share. Finally, the length of the quote time series is set to 500 days

corresponding to 2 solar year of financial market trading days. Since,

the "Original Turtle Trading System" is substantially a trend follower

that use breakin and breakout signals with periods of thens of days,

it is important to have a quote length of at least 2 years to let the

System to execute a minimum number of trading operations to evaluate

its performance.

|